Amazon shares declined more than 10% in after-hours trading Thursday after the Seattle tech giant revealed its first quarter earnings report and provided a lower-than-anticipated sales forecast for the second quarter, due in part to rising costs and inflation.

Revenue for the first quarter came in at $116.4 billion, which met estimates and was up 7% year-over-year. That’s the slowest growth rate for revenue in more than two decades.

Amazon posted a net loss of $3.8 billion, or $7.56 per diluted share. The net loss includes a pre-tax valuation loss of $7.6 billion included the company’s non-operating expense from its investment in automaker Rivian.

Without the Rivian impact, Amazon would have posted a profit of $3.8 billion, which still translates into earnings below Wall Street’s expectations of $8.07 per share.

Operating income came in at $3.7 billion, down from $8.9 billion in the year-ago quarter.

Looking ahead, the company’s Q2 sales forecast of $116 billion to $121 billion came in below estimates. Operating income for the second quarter is expected to range between a $1 billion loss and a $3 billion profit, down from $7.7 billion in the second quarter of 2021.

Amazon CEO Andy Jassy cited ongoing inflationary and supply chain pressure in the earnings press release: “The pandemic and subsequent war in Ukraine have brought unusual growth and challenges,” Jassy said.

Amazon is also dealing with rising wage costs. In September the company said it was raising average hourly U.S. wages to $18 an hour for warehouse workers. Amazon announced in February that it is more than doubling max base pay for corporate and tech employees to $350,000.

The company said today it added $2 billion in incremental costs compared to the year-ago quarter due to inflationary pressures. The cost of shipping a container overseas has more than doubled compared to pre-pandemic rates, and the cost of fuel is 1.5 times higher than a year ago, Amazon CFO Brian Olsavsky said on a call with reporters Thursday.

Earlier this month, Amazon announced a 5% fuel and inflation surcharge for sellers on its marketplace who use the company’s shipping services, due to an unexpected increase in costs.

Amazon’s stock is down more than 20% this year, part of larger downturn for tech stocks. The company’s market capitalization is $1.47 trillion, making it the fourth most-valuable U.S. tech company behind Apple, Microsoft, and Alphabet.

Amazon also announced today that Prime Day will take place in July.

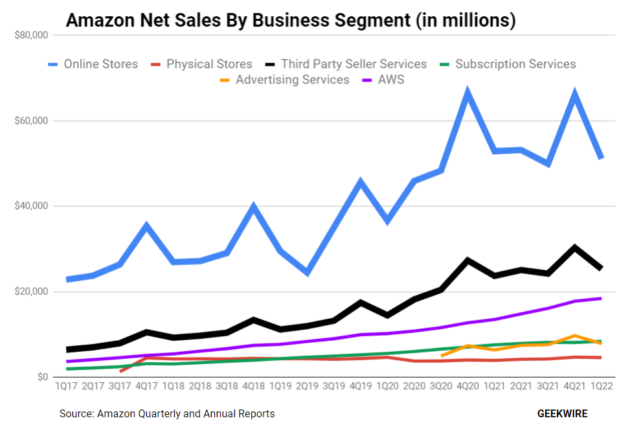

Here’s a quick breakdown of the company’s financials for the first quarter.

Online stores: Revenue was down 3% year-over-year to $51.1 billion.

Amazon Web Services: Amazon’s cloud business was up 37% at $18.4 billion, with $6.5 billion in operating income, continuing to help drive Amazon’s profits. AWS now has an annual run rate of more than $73 billion.

Shipping costs: Amazon’s shipping costs have ballooned in recent years as the company aims to speed up delivery with its push for one-day shipping. During Q1, Amazon spent $19.5 billion on shipping, up 15%. Olsavsky said the company now has “excess capacity” in its facilities and transportation network after building those out during the pandemic. This contributed to $2 billion in additional costs in Q1, he said.

Physical stores: The category, which includes Whole Foods and Amazon Go stores, posted revenue of $4.6 billion, up 17%. Amazon announced in March that it was closing its bookstores, 4-Star, and PopUp retail outlets to focus on grocery and fashion.

Advertising: The company recently started breaking out financials for its growing advertising arm, which brought in $7.8 billion in revenue in the quarter, up 23% over a year ago.

Headcount: Amazon now employs 1.6 million people, up 28% year-over-year. That figure does not include seasonal and contract workers.

Prime: Subscription services revenue, which includes Prime memberships, came in at $8.4 billion, up 11%. Amazon earlier this year announced a $20 increase in its annual Prime membership fee, to $139 from $119 previously.