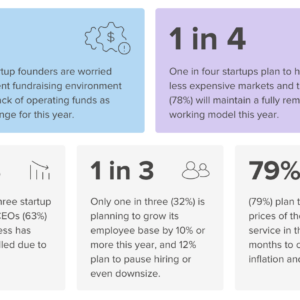

A trio of technology and finance veterans are taking on large banks and multi-family offices with a new wealth management firm targeting tech founders and employees.

Cloud Capital launched earlier this year and aims to address a “pain point” in the wealth management industry that includes providing services to those with equity positions tied to companies that saw massive growth during the tech boom.

The firm says it will provide comprehensive wealth management services for its clients, which includes assistance with taxes, equity compensation, and family communication. It also aims to provide clients access to “top-tier” venture capital funds by pooling assets, meaning their clients won’t have to commit vast swaths of cash to participate in that asset class.

The firm’s founders are veterans in the finance and tech space. Hart Williams and Taylor Heininger held leadership positions at Bessemer Trust, a private multi-family office. Sean Sternbach was a product manager at Amazon and the co-founder of a Seattle-based entrepreneurial program called Venture Out Seattle.

While other wealth management firms have similar offerings, Cloud Capital is tapping into the deep pockets of the individuals that profited off of the tech boom in Seattle and other parts of the West Coast. More wealth managers are in demand to watch over these large individual estates, with assets somewhere around $2-to-$20 million.

Wealth managers can also help clients navigate evolving tax codes, such as the controversial Washington state capital gains tax.

Cloud Capital is working with about 15 families, and another 5-to-7 are planning to commit. It also serves about 20 founders who are in the “pre-liquidity” phase of their equity compensation. The firm currently has about $30 million of assets under management, and it makes its money by taking a percentage of that.