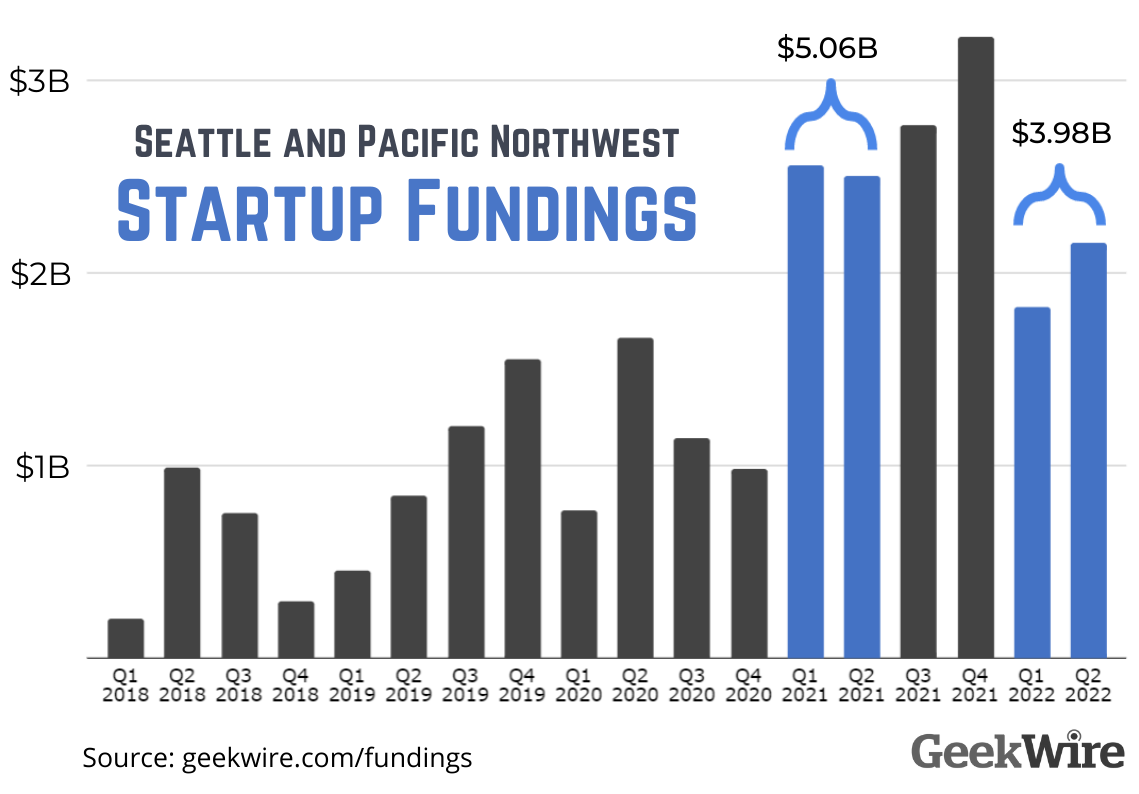

Tech startups in Seattle and the Pacific Northwest raised less than $4 billion in funding in the first half of 2022, down 20% from more than $5 billion in the first half of 2021, according to a new analysis of GeekWire’s startup funding list.

The calculations confirm and quantify the impact of the economic slowdown on startups in the region. Angel investors and venture capitalists have been tightening their belts and urging portfolio companies to extend their financial runways. This caution is contributing to a wave of layoffs by tech companies.

GeekWire tracks tech funding deals in Washington, Oregon, Idaho and British Columbia as part of its reporting on startups in the the Pacific Northwest.

More takeaways from latest numbers:

- The total number of fundings declined to 138 in the first half of 2022, vs. 164 in the first half of 2021.

- By comparison, the total number of deals was 133 in the first half of 2020, at the onset of the pandemic.

- Looking at just the second quarter of 2022, the total value of deals was $2.2 billion, up from $1.8 billion in the first quarter. However, that increase was due largely to a few large deals (see list below).

- The total number of deals declined to 63 in the second quarter, from 75 deals in the first quarter.

Anecdotal evidence suggests similar trends nationally, but quarterly numbers from PitchBook/NVCA and CB Insights typically aren’t released until later in the month. The slowdown in the Pacific Northwest follows record venture capital numbers for the Seattle region and Washington state in 2021.

Top 10 deals in the Pacific NW for the second quarter, as tracked by GeekWire:

- Group14 Technologies, battery technology, $400 million.

- Convoy, trucking marketplace, $260 million.

- Zap Energy, fusion power, $160 million.

- Agility Robotics, warehouse robots, $150 million.

- Echodyne, high-tech radar, $135 million.

- SirionLabs, contract lifecycle management, $85 million.

- ProfoundBio, anti-cancer agents, $55 million.

- Flexe, on-demand warehousing, $67.9 million.

- Edge Delta, data analysis, $63 million.

- AccelByte, online games infrastructure, $60 million.

One notable trend is the number of hardware companies near the top of the list. The region is historically better-known for software, services, and cloud technologies, but hardware development is often more capital-intensive.