Earlier this month, the U.S. Environmental Protection Agency set new water health advisories for PFAS, or “per- and polyfluoroalkyl substances.” These so-called “forever chemicals” rarely break down in the environment and are commonly used in consumer goods such as waterproof clothing, non-stick pans, and food packaging. PFAS can eventually end up in our drinking water, soil, and air. Scientific studies have shown that exposure to PFAS can lead to adverse health outcomes, according to the EPA.

Now an up-and-coming startup based in Seattle is taking on PFAS.

Nigel Sharp, Brian Pinkard, and Chris Woodruff are the co-founders of Aquagga, a 3-year-old cleantech hardware startup developing technology to break down and destroy PFAS. The company traces its roots to research done at the University of Washington and University of Alaska.

Sharp, CEO, has years of experience in building startups. Pinkard, CTO, has a PhD from the UW with a focus on hazardous waste destruction. And Woodruff, COO, has a deep engineering background.

Aquagga provides PFAS destruction services for water engineering and environmental remediation projects. Its containerized system uses high temperatures and pressures to break the carbon-fluorine bonds that hold PFAS molecules together — one of the strongest chemical bonds in nature. According to Pinkard, the technology completely destroys PFAS molecules and eliminates wastewater contamination with no toxic byproducts. This effectively reduces water and soil contamination, helping maintain sustainable environments.

“The only solution to PFAS is to physically clean it up from the environment, capture it, and break it down. We’re working on that latter step,” Pinkard said. “The secret sauce that we provide is actually taking these molecules and breaking them apart into safe minerals. We end that cycle and remove PFAS from the world.”

By 2025, Sharp estimates the potential market size for PFAS to be about $80 billion a year in the U.S. He adds that PFAS destruction likely makes up 5% to 10% of the market — about $4 to $8 billion a year.

PFAS was the focus of a Last Week Tonight episode in October. Host John Oliver explained that even if consumers choose to be responsible, PFAS can still enter their bloodstream and lead to dangerous health effects if factories do not properly dispose of waste.

While significant progress has been made to remove the need for PFAS in industrial uses, there is still high demand for PFAS in everyday consumer products, according to the Aquagga team.

The team chose the name “Aquagga” for its technology because “quagga” is an extinct mammal resembling the African Zebra, and the startup’s goal is to make a positive social impact as a “zebra” company, according to Sharp. He said the company aligns with the Zebras Unite movement that emphasizes startup ethicality and cooperation over competition.

Aquagga currently has 10 full-time employees and aims to be a certified B Corporation in the future, an accreditation given to companies that meet the highest standards of social and environmental performance.

Aquagga won first place in the EPA Global PFAS Challenge and the Alaska Airlines Environmental Innovation Competition. It has also received grants from the National Science Foundation, the EPA, and the U.S. Air Force. Through these federal grants and awards, Aquagga has raised about $2 million. In addition, Aquagga raised just over $500,000 of private angel funding from angel investors.

Sharp will be featured in the sustainability category of the third season of GeekWire’s Elevator Pitch series, airing later this summer.

We caught up with co-founders Sharp and Pinkard for this Startup Spotlight feature. Continue reading to learn more about Aquagga.

Our business model and customers: We’re a full service company and we generally tag along on the back end of other treatment solutions that are used to filter PFAS out of, for example, water. Our customers are often prime contractors who are already doing environmental site remediation projects or large water engineering firms, who are actually putting in engineering services for water utilities and for wastewater utilities. There’s a huge opportunity for us to work with the Department of Defense which has a lot of sites heavily impacted with PFAS.

“PFAS aren’t going anywhere.”

The volume of PFAS destruction we can handle and our scaling limits: Our current systems do 1 to 2.5 gallons per hour. Honestly, it’s a very straightforward technology to scale. So expect to be orders of magnitude larger than that within the next two years. By the end of this year, we’ll be up to 10 to 20 gallons per hour with a system. Putting our total combined effort, you should be able to process somewhere close to 30,000 to 40,000 gallons an hour in the near future, and that makes a real dent to the problem.

The smartest move we’ve made so far: A risky switch from completely remote spread over multiple states to in-person at the Maritime Blue Incubator program in Tacoma, Wash. in 2021. Beyond office space, it offered us access to a wet lab to do some of our initial testing and technology proof cases, and we arrived at a moment that allowed many in the South Puget Sound to get behind us and highlight our arrival which helped with maintaining our momentum.

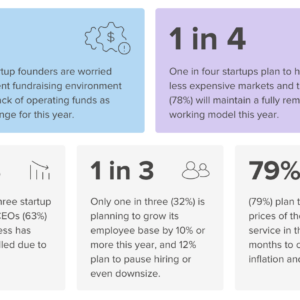

How the economic uncertainty is affecting our business and how we are preparing: Like any startup, our superpower is agility and the ability to pivot to opportunities and adjust to emerging challenges. The macro economic uncertainty, fortunately, doesn’t apply to some of our federal funding sources (other than causing delays). It has made it harder to hone in on specific fundraising valuations with venture capitalists, but we’re still seeing strong market pull and the need for our services. As we often say internally, PFAS aren’t going anywhere, so it’s an inevitability, just a question of priority.