In the dynamic landscape of business, franchises have emerged as a popular model for entrepreneurs to expand their ventures. With the increasing complexity of financial transactions and the need for streamlined management, accounting software has become an indispensable tool for franchises. This article explores the significance of accounting software in the context of franchises, examining its benefits, features, and the impact it can have on the overall success of franchise operations.

Contents

I. The Franchise Landscape:

Franchising has become a widespread business model across various industries, offering entrepreneurs the opportunity to own and operate their own businesses while benefiting from the established brand and support of a larger parent company. However, managing finances in a franchise environment can be challenging due to the decentralized nature of operations.

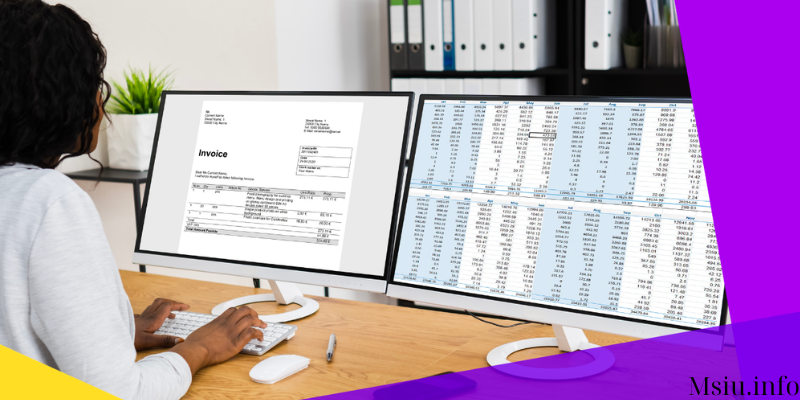

Franchises often have multiple locations, each with its own set of financial transactions, expenses, and revenue streams. Traditional accounting methods can be time-consuming and prone to errors, making it essential for franchises to adopt modern accounting solutions that provide efficiency, accuracy, and real-time insights.

II. The Benefits of Accounting Software for Franchises:

- Centralized Financial Management: Accounting software allows franchises to centralize financial data from various locations. This centralized approach enables franchise owners and managers to have a comprehensive view of the entire business, making it easier to monitor financial performance, identify trends, and make informed decisions.

- Real-time Reporting: One of the key advantages of accounting software is its ability to generate real-time reports. Franchise owners can access up-to-the-minute financial data, enabling them to respond promptly to changing market conditions, address issues promptly, and capitalize on emerging opportunities.

- Cost Control and Expense Tracking: Efficient expense tracking is crucial for franchises to control costs and maintain profitability. Accounting software provides tools for tracking expenses at each franchise location, helping owners identify areas of overspending and implement cost-saving measures.

- Standardized Financial Processes: Standardizing financial processes across all franchise locations is essential for maintaining consistency and ensuring accurate reporting. Accounting software allows franchises to establish standardized accounting procedures, reducing the likelihood of errors and ensuring compliance with regulatory requirements.

- Improved Accuracy and Compliance: Automated accounting processes significantly reduce the risk of manual errors. Additionally, many accounting software solutions are designed to ensure compliance with relevant accounting standards and tax regulations, providing peace of mind to franchise owners.

III. Key Features of Accounting Software for Franchises:

- Multi-location Support: A critical feature for accounting software in a franchise setting is the ability to support multiple locations. This ensures that each franchise unit’s financial data is accurately recorded and consolidated for comprehensive reporting.

- User Permissions and Access Controls: Accounting software allows franchises to set user permissions and access controls. This ensures that sensitive financial information is only accessible to authorized personnel, maintaining the confidentiality and security of financial data.

- Integration with Point-of-Sale Systems: Many franchises rely on point-of-sale (POS) systems for transaction processing. Accounting software that integrates seamlessly with POS systems streamlines the recording of sales data, reducing manual data entry and minimizing errors.

- Inventory Management: For franchises involved in retail or the sale of physical products, integrated inventory management features are essential. Accounting software can help track inventory levels, manage stock, and provide insights into product performance.

- Automated Invoicing and Billing: Streamlining the invoicing and billing processes is critical for franchises dealing with numerous transactions. Accounting software automates these processes, reducing the time spent on manual invoicing and improving cash flow management.

- Financial Forecasting and Budgeting: Accounting software equipped with forecasting and budgeting tools allows franchises to plan for the future. By analyzing historical data and market trends, franchise owners can make informed decisions to optimize financial performance.

IV. Selecting the Right Accounting Software for Franchise:

- Scalability: Choose accounting software that can grow with your franchise. Scalability is crucial to accommodate the expansion of your business and the increasing volume of financial transactions.

- Cloud-based vs. On-premise Solutions: Consider whether a cloud-based or on-premise accounting solution is more suitable for your franchise. Cloud-based options provide accessibility and flexibility, while on-premise solutions may offer greater control over data.

- Integration Capabilities: Ensure that the accounting software can seamlessly integrate with other business applications used within your franchise, such as CRM systems, payroll software, and POS systems.

- User-Friendly Interface: Opt for accounting software with an intuitive and user-friendly interface. This is especially important for franchises with diverse users, including business owners, managers, and accounting staff.

- Customer Support and Training: Evaluate the level of customer support and training provided by the accounting software provider. Adequate support and training resources are essential for the successful implementation and utilization of the software.

V. Case Studies: Success Stories of Franchises Leveraging Accounting Software:

- XYZ Fast Food Chain: This case study explores how a fast-food franchise streamlined its financial processes by adopting cloud-based accounting software. The franchise experienced improved accuracy in reporting, faster decision-making, and increased overall efficiency.

- ABC Fitness Studios: Examining the journey of a fitness studio franchise that integrated accounting software with its POS system. The software enabled real-time tracking of membership fees, class revenues, and expenses, resulting in better financial control and profitability.

- Data Security: Franchises must prioritize data security when implementing accounting software. Ensuring that the chosen solution adheres to industry-standard security protocols is vital to protect sensitive financial information.

- Training and Adoption: Overcoming resistance to change and ensuring that all users are adequately trained on the new accounting software is a common challenge. Franchises should invest in comprehensive training programs to maximize the benefits of the software.

- Cost Considerations: While accounting software offers numerous benefits, franchises must consider the associated costs. This includes not only the initial software purchase but also ongoing subscription fees, training expenses, and potential integration costs.

VI. Future Trends in Franchise Accounting Software:

- Artificial Intelligence (AI) and Automation: The integration of AI and automation is expected to play a significant role in the future of franchise accounting software. AI-powered tools can analyze large datasets, identify patterns, and automate routine accounting tasks.

- Blockchain Technology: Blockchain technology may revolutionize financial transactions within franchises by providing a secure and transparent ledger. This could enhance trust between franchisees and franchisors and streamline financial transactions.

- Enhanced Reporting and Analytics: The demand for more advanced reporting and analytics features will likely drive the development of accounting software. Franchises will benefit from tools that offer deeper insights into financial performance and facilitate more informed decision-making.

Conclusion

In the ever-evolving world of business, franchises face unique challenges in managing finances across multiple locations. Accounting software has emerged as a powerful solution, offering centralized financial management, real-time reporting, and a range of features tailored to the specific needs of franchises. As technology continues to advance, the role of accounting software in the success of franchises is set to expand, providing a foundation for efficient and data-driven financial management. Franchise owners who embrace these technological advancements will be better positioned to navigate the complexities of the business landscape and achieve sustained growth and profitability.