For sole proprietors, managing finances and keeping track of business transactions can be a daunting task. As the sole owner and operator of their businesses, they often handle everything from sales to bookkeeping, which can quickly become overwhelming without the right tools. Thankfully, the advent of accounting software has revolutionized how small business owners handle their financial responsibilities. In this article, we will delve into the world of affordable accounting software for sole proprietors. We will explore their key features, benefits, and pricing structures to help you make an informed decision that aligns with your business needs and budget.

Contents

Understanding the Needs of Sole Proprietors

As a sole proprietor, you wear many hats, making it crucial to find accounting software that caters to your specific requirements. Typically, sole proprietors prioritize software that is easy to use, cost-effective, and capable of streamlining tasks like invoicing, expense tracking, tax preparation, and financial reporting. Cloud-based solutions are also popular for their accessibility and ability to synchronize data across devices.

Top Affordable Accounting Software for Sole Proprietors

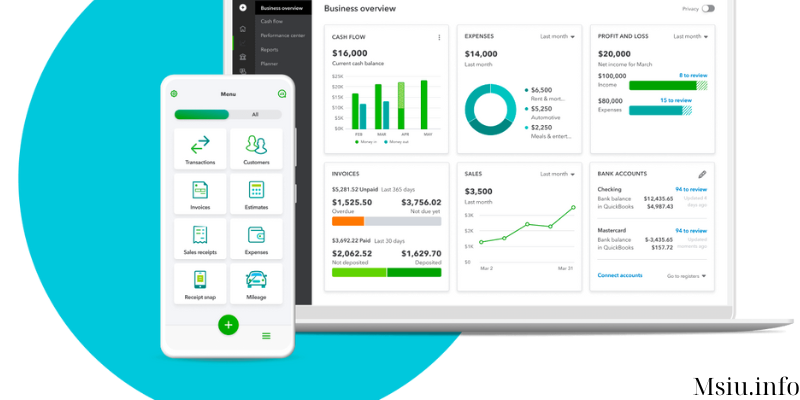

2.1. QuickBooks Online

QuickBooks Online is a leading accounting software option, suitable for sole proprietors and small businesses alike. Known for its user-friendly interface and powerful features, QuickBooks Online helps manage invoicing, track expenses, and generate financial reports. With various pricing plans, it offers flexibility for businesses at different stages of growth.

Key Features:

Invoicing: Create professional invoices and track payments effortlessly.

Expense Tracking: Categorize and monitor business expenses for better financial control.

Bank Reconciliation: Seamlessly sync bank accounts to reconcile transactions.

Reporting: Access a range of financial reports, including profit and loss, balance sheets, and cash flow statements.

Mobile App: Manage your finances on-the-go with the QuickBooks Online mobile app.

2.2. Xero

Xero is another popular cloud-based accounting software suitable for sole proprietors. It boasts a simple and intuitive interface, making it easy to navigate for users with little accounting knowledge. Xero allows collaboration with accountants and integrates with various third-party apps to streamline business processes further.

Key Features:

Bank Connections: Automatically import and categorize bank transactions.

Invoicing: Create and send customized invoices to clients, complete with online payment options.

Expense Claims: Manage and reimburse business expenses with ease.

Inventory Management: Track and monitor inventory levels and sales in real-time.

Multi-Currency Support: Conduct business internationally with support for multiple currencies.

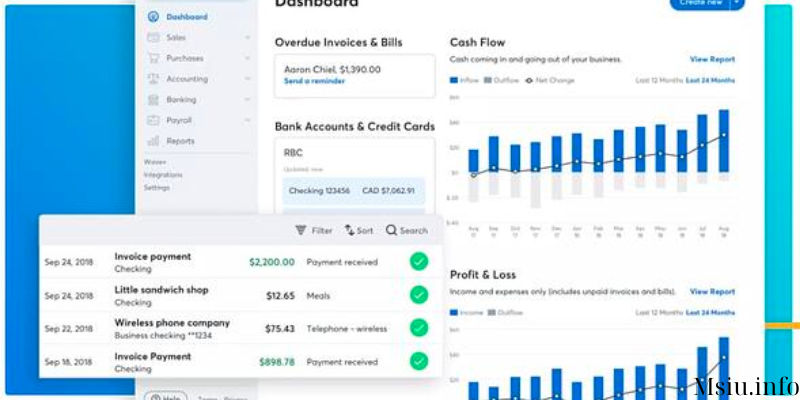

2.3. Wave Financial

Wave Financial offers a unique advantage for sole proprietors by providing its accounting software for free. This makes it an attractive option for startups and small businesses with limited budgets. Despite being free, Wave offers robust features to help manage financial tasks efficiently.

Key Features:

Invoicing: Customize and send invoices to clients, with options for recurring billing.

Receipt Scanning: Scan and upload receipts for easy expense tracking.

Personal and Business Accounting: Separate personal and business transactions for clearer financial records.

Bank Reconciliation: Automatically import and reconcile bank transactions.

Payroll: Affordable payroll processing for easy employee management.

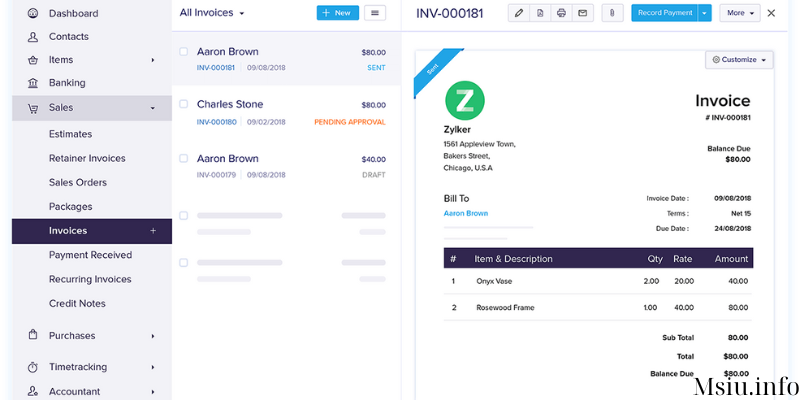

2.4. Zoho Books

Zoho Books is an accounting software solution designed for small businesses and sole proprietors. With its wide range of features and integration capabilities, it provides a comprehensive solution for managing finances and streamlining business operations.

Key Features:

Client Portal: Provide clients with access to their invoices and payment status through a secure portal.

Time Tracking: Monitor billable hours for accurate invoicing and payroll processing.

Automations: Set up workflows and automate repetitive tasks to save time.

Project Accounting: Track income and expenses for specific projects or clients.

Bank Feeds: Connect bank accounts for seamless transaction tracking.

Key Considerations when Choosing Accounting Software

When selecting accounting software as a sole proprietor, several factors should be considered to ensure that it aligns with your business needs and budget:

3.1. Pricing

Affordability is a top priority for sole proprietors, especially those just starting. Look for software with transparent pricing plans that cater to your business size and needs. Some software offers free versions or trial periods, providing an opportunity to test the platform before committing.

3.2. User-Friendliness

As a sole proprietor, you may not have a background in accounting, so it’s crucial to choose software with an intuitive interface. User-friendly software will help you navigate the platform efficiently and reduce the learning curve.

3.3. Scalability

While your business may be small now, you should consider software that can grow with you. As your business expands, you’ll want a solution that can accommodate increased transaction volumes and additional features.

3.4. Integration Capabilities

To enhance productivity, look for accounting software that integrates seamlessly with other essential tools you use, such as payment processors, e-commerce platforms, or customer relationship management (CRM) systems.

3.5. Security

With sensitive financial data at stake, security is of utmost importance. Choose software that implements industry-standard security measures to protect your financial information from potential threats.

Conclusion

As a sole proprietor, choosing the right accounting software is vital for maintaining accurate financial records, streamlining operations, and making informed business decisions. The options mentioned in this article, including QuickBooks Online, Xero, Wave Financial, and Zoho Books, are all excellent choices for sole proprietors due to their affordability and feature-rich offerings.

When selecting accounting software, consider your business needs, budget constraints, and long-term goals. Take advantage of free trials or demos to test each platform and determine which one best suits your unique requirements. By investing in the right accounting software, you can gain better control of your finances, save time on administrative tasks, and focus on growing your business.