The news: Founded two years ago, Tacoma Venture Fund has made several investments in early-stage startups across the Pacific Northwest, with a particular focus on the Tacoma, Wash., area south of Seattle.

Why it matters: TVF, which is investing out of a $12.3 million first fund, is the latest early-stage firm to pop up in the Seattle region. “We believe the Pacific Northwest is one of the most powerful ecosystems in the country with strength in the startup and investing scenes,” said Dennis Joyce, director of investments. “We hope to emerge as another source of needed capital for emerging technology companies.”

The people: Joyce is a longtime Seattle-area angel investor and previously was managing director at a family office called Claddagh Venture. Other leaders at TVF include Bill Driscoll, chairman and CEO of Clearwater Management Company, and Steve Gordon, former COO of Gordon Trucking.

The portfolio: TVF has made nearly 20 investments, including seven this year. Its portfolio spans various industries and includes Copper Banking, BearTax, Proxi, Brightly, GiveInKind, and Violett.

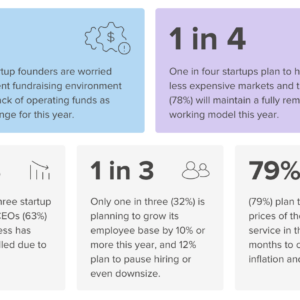

The downturn: “We have been rigorous in our internal processes to invest in companies that we think can survive uneasy marketplaces and build long term value in our ecosystem,” Joyce wrote in a recent TVF newsletter.

Last word: Joyce said the Tacoma-area startup ecosystem is emerging but “capital starved.” It has existing infrastructure by way of several co-working spaces and the University of Washington’s Tacoma campus, which produces tech talent. The region also offers lower home prices compared to Seattle, a potential draw for tech workers looking to relocate amid the rise of remote work during the pandemic. TVF hopes to ride these trends and provide capital to local companies, helping them scale and have a positive impact on the larger community.