Tax accounting is a crucial aspect of financial management for individuals and businesses alike. With the ever-changing tax laws and regulations, accurately managing and reporting taxes can be a daunting task. However, the advent of tax accounting software has revolutionized the way taxes are handled. In this comprehensive guide, we will explore the evolution, benefits, and impact of tax accounting software, highlighting its role in simplifying tax compliance, improving accuracy, and enhancing financial decision-making.

Contents

I. Evolution of Tax Accounting Software

- Early Days of Manual Tax Calculation

- Before the digital era, tax calculations were largely done manually.

- This process was time-consuming and prone to errors.

- Limited access to tax resources made it challenging to keep up with changing tax laws.

- Emergence of Early Tax Software

- In the 1980s and 1990s, rudimentary tax software emerged.

- These early systems provided basic calculations and forms for individual taxpayers.

- They marked the first step toward automating tax processes.

- The Pioneering Years of Tax Accounting Software (2000s)

- The early 2000s saw the development of more sophisticated tax accounting software.

- These systems started catering to various tax needs, including businesses and complex tax situations.

- User-friendly interfaces began to appear, making it easier for non-experts to use.

- The Rise of Cloud-Based Solutions

- In the mid-2000s, cloud-based tax accounting software gained prominence.

- This allowed for greater accessibility and collaboration among users.

- Real-time updates and data synchronization became possible.

- Current State of Tax Accounting Software

- Today, tax accounting software has evolved into a diverse ecosystem.

- Solutions are available for individuals, small businesses, corporations, and tax professionals.

- Artificial intelligence and machine learning are being incorporated for enhanced accuracy.

II. Benefits of Tax Accounting Software

- Improved Accuracy

- One of the primary advantages of tax accounting software is its ability to perform complex calculations with precision.

- It minimizes the risk of mathematical errors and ensures compliance with tax laws.

- Time Savings

- Automation of data entry and calculations significantly reduces the time required for tax preparation.

- Users can import financial data directly from other software, such as accounting systems.

- Accessibility and Mobility

- Cloud-based tax software allows users to access their tax information from anywhere with an internet connection.

- This is especially beneficial for businesses with remote or distributed teams.

- Cost Savings

- While tax software may have an initial cost, it often proves more cost-effective than hiring a tax professional.

- It also reduces the risk of penalties and fines due to filing errors.

- Real-time Updates

- Tax laws and regulations change frequently.

- Tax software providers regularly update their systems to reflect these changes, ensuring compliance.

- Data Security

- Reputable tax software providers implement robust security measures to protect sensitive financial data.

- This is often more secure than maintaining paper records or spreadsheets.

III. Key Features of Tax Accounting Software

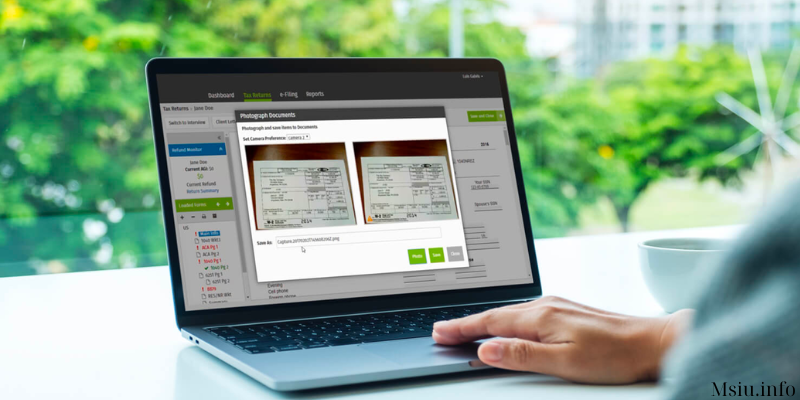

- Tax Preparation and Filing

- Tax software streamlines the process of preparing and filing tax returns.

- It guides users through relevant forms and calculations, reducing the risk of errors.

- Integration with Financial Systems

- Many tax software solutions can integrate with accounting and financial software.

- This allows for seamless transfer of financial data, reducing manual data entry.

- Audit Support

- Some tax software provides audit support, including access to tax experts and resources to assist with IRS audits.

- E-filing

- E-filing is a convenient feature that allows users to electronically submit their tax returns to government agencies.

- It speeds up the refund process and reduces the risk of lost paperwork.

- Tax Planning and Forecasting

- Advanced tax software can provide tax planning tools that help users optimize their financial decisions to minimize tax liabilities.

- Document Management

- Many tax software solutions offer document storage and organization features to keep all tax-related documents in one place.

- Multi-User Access

- Business-focused tax software often allows multiple users to collaborate on tax-related tasks, such as data entry and review.

IV. The Impact of Tax Accounting Software

- Small Businesses and Entrepreneurs

- Tax accounting software has been a game-changer for small businesses and entrepreneurs.

- It empowers them to handle their tax obligations efficiently, reducing the need for costly professional services.

- Tax Professionals

- Tax professionals have also benefited from tax software.

- It enhances their productivity by automating repetitive tasks, allowing them to focus on complex tax planning and consulting.

- Government Tax Agencies

- Tax software has simplified the process of tax collection and auditing for government agencies.

- E-filing and electronic record-keeping have improved efficiency on both sides.

- Improved Compliance

- Tax software has contributed to better compliance with tax laws.

- Automated checks and validations help users identify and rectify errors before filing.

- Data-Driven Decision-Making

- With access to accurate and up-to-date financial data, businesses can make informed financial decisions.

- Tax software plays a role in overall financial management and planning.

-

The Impact of Tax Accounting Software

Conclusion

Tax accounting software has come a long way since its inception, revolutionizing the way individuals and businesses manage their taxes. Its evolution has brought about improved accuracy, time savings, and enhanced accessibility. As technology continues to advance, tax software will likely become even more sophisticated, providing users with more comprehensive tools for tax compliance and financial planning. Whether you’re an individual taxpayer or a business owner, embracing tax accounting software can streamline your financial management and help you navigate the complex world of taxation with confidence.