A husband-and-wife duo and tech veteran are jumping into the crowded space of real estate investing with a startup that aims to simplify identifying and managing single-family rental properties.

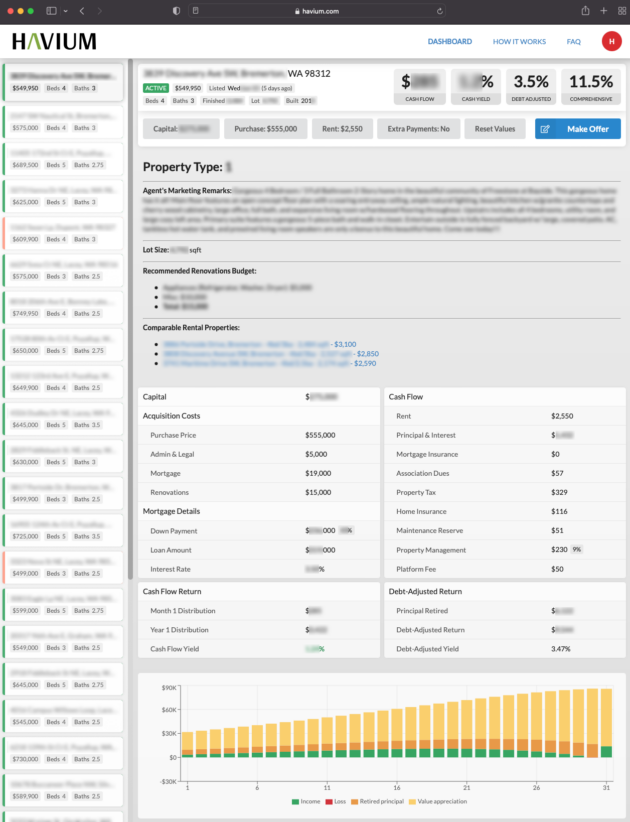

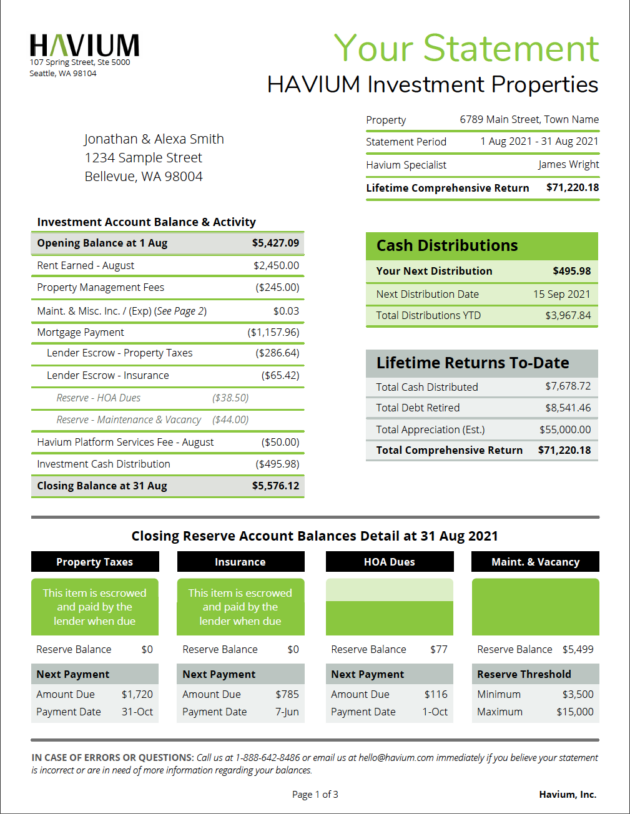

The Seattle-based company called Havium provides two services: Its software component scours real estate offerings for lucrative investment opportunities in a select region, while its concierge service connects its clients with a property management company that will provide tenants and handle upkeep.

“Imagine you could put on a pair of glasses and look at any property or look out over the entire state of Washington and only see the properties that make sense to buy as an investment,” said CEO and co-founder Jamie Nacht, who previously held a leadership role at J.P. Morgan.

Nacht co-founded the company with Cristin Nacht, his wife, and their technical co-founder Arash Motamedi, who currently holds a leadership role at Microsoft.

The 5-year-old startup currently manages a portfolio of homes worth more than $16 million spread across various markets in the Pacific Northwest. The company has already generated nearly $2.7 million of wealth for its clients, according to its website.

Havium is gearing up to scale, gaining approval in both Idaho and Oregon to expand its operations. It aims to finance this growth and build out its suite of services by raising outside capital for the first time.

Because the company expedites the process of identifying and operating an investment-worthy property, it has also become an attractive option for those looking to participate in a 1031 exchange, where real estate investors have a limited time frame to swap one investment property for another to avoid paying capital gains tax.

“Historically, people run around like crazy trying to find properties that can pencil correctly,” Jamie Nacht said. “People come to us beforehand and they say, ‘Hey, I’m going to sell this property and the day that it’s going to be sold is next Thursday.’ And then we just tell our system next Thursday is the first day that we’re allowed to buy property for this client.”

Havium is going after a massive market. The company estimates that there are an average of 6.5 million single-family homes that are put on the market each year in the U.S.

The startup makes its money in a variety of ways. It takes a commission at both the purchase and sale of client investments, charges one-time platform onboarding fees, and has recurring monthly revenue from each investment property in operation.

The company said it will be adding several additional revenue lines based on services its clients have been requesting.

So-called proptech, which includes real estate investing platforms such as Havium, has become a crowded space. Several related startups have sprung up, with each filling out their own niche.

Arrived Homes, for example, allows users to crowdfund a micro real estate investment trust. Its focus is to lower the barrier-to-entry to that asset class for its users. Pacaso allows wealthy investors the chance to own a portion of a luxury house, ranging from 2-to-8 owners per property. And LEX, a New York-based investment company, announced it plans to take the SOLIS building in Seattle’s Capitol Hill neighborhood public.

These proptech startups meanwhile have faced criticism for gobbling up a limited supply of homes, particularly in cities with high housing costs. Pacaso, for example, faced pushback in communities ranging from Napa Valley to Maui for allegedly driving up property values.

Asked how Havium fits into this conversation, Jamie Nacht argued that the company operates in markets where investing in single-family homes does not affect the overall prices, such as the Pacific Northwest.

Rising interest rates have made purchasing a home harder for some would-be buyers. This, in turn, is creating more demand for rental property inventory.

“If there are more people looking for rental housing — and if you own during that period — it’s better for you,” he added. “It’s countercyclical to the house prices.”

One way to describe Havium’s target client is to put them in the “high earner, not rich yet” category, or a so-called “H.E.N.R.Y.” This might be a tech worker with a large equity compensation package, or someone who was recently hired as a surgeon, among others.

“They want to invest in real estate,” co-founder Cristin Nacht said. “But they don’t have the time or the desire to handle all of the stuff that goes along with it.”

Up until this point, the startup has bootstrapped its finances, relying only on word-of-mouth advertising to market its services. Cristin Nacht said this has allowed the company to refine how it operates, setting it up to be able to scale effectively into new markets.

Havium plans to use additional funding to fuel software development, hiring, expanding into new market geographies, and helping clients finance their property investments.