Every firm, no matter how big or little, needs accounting software.

You may monitor and keep track of your financial transactions with its assistance. We’re going to introduce Kashoo-the Best Accounting Software For Small Enterprise.

Kasho is straightforward Accounting Software For Small Enterprise that can be used by any small business. A free plan is also available for sending estimates, invoices, payments, tracking earnings, and keeping track of clients. For all of you, this could be a useful accounting tool. Let’s investigate it together.

1. An Overview of Kashoo

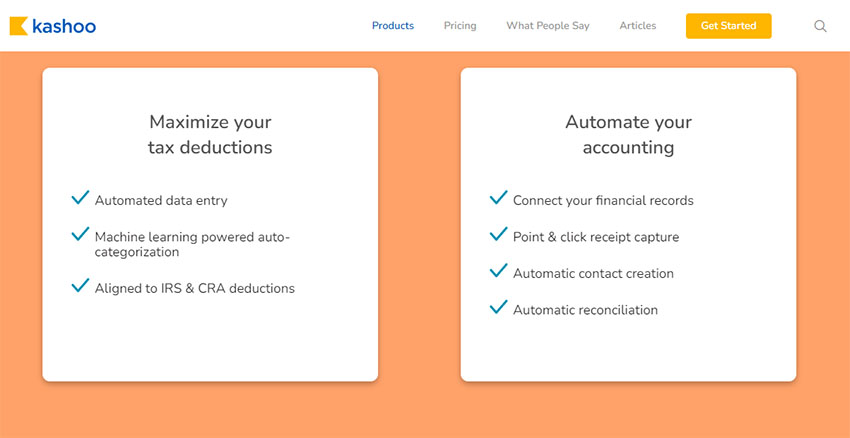

In addition to having a unique name, Kashoo provides a number of features that may appeal to extremely small businesses looking to automate their accounting system. Kashoo, for instance, was the first company to create an iPad app for its online service. It provides free voice, email, and chat help. One of the greatest services of its sort, SurePayroll, can be coupled with Kashoo double-entry accounting principles. Since we wrote our last assessment, the company has improved categorization and bank feeds on the website.

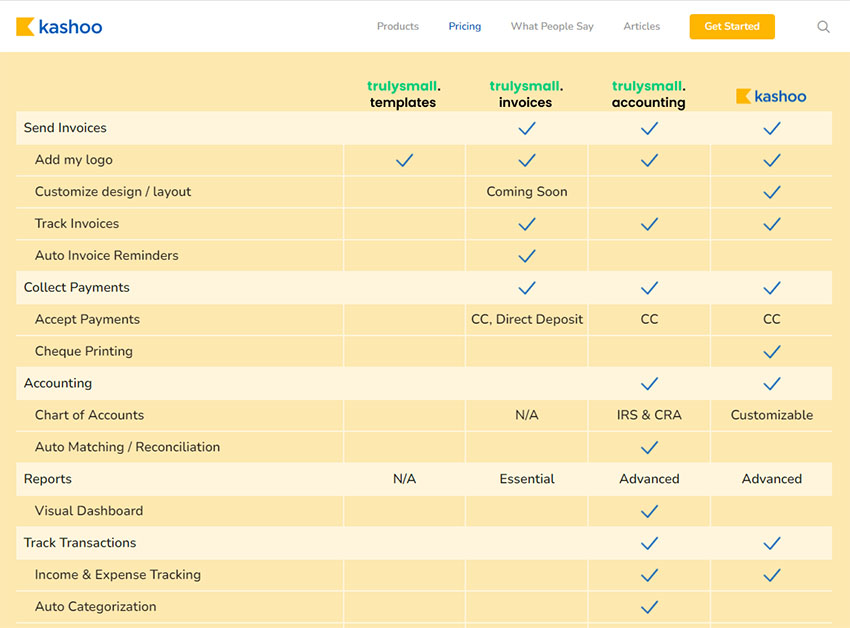

The company chose to take a step back and cater to the needs of new, extremely small businesses that hadn’t yet made the leap from manual bookkeeping to a cloud-based accounting solution, given that the majority of its members are micro-businesses. Since creating invoices is typically the first chore that a new company (or one that only wants to dabble with automation) begins with, Kashoo created TrulySmall Invoices, a free invoicing solution that is really straightforward.

Additionally, Kashoo released TrulySmall Accounting ($20 monthly), a double-entry accounting program that enables you to download transactions from your bank accounts, keep track of earnings, expenses, and bills, send invoices and accept payments, and run crucial reports. Both TrulySmall programs are user-friendly, plainly constructed, and aesthetically beautiful because they were made with mobile devices in mind first (and are accessible as iOS and Android apps).

2. Why Kashoo is the Best Accounting Software For Small Enterprise?

If you are still wondering which Accounting Software For Small Enterprise to choose for your business, read the outstanding advantages of Kashoo Software below, so you can be sure that Kashoo is the Best Accounting Software For Small Enterprise.

Kashoo was developed to simplify the accounting and billing procedures for small enterprises and independent contractors. To make the process of communication between accountants and business owners easier, you can use a web version of an app or download a mobile app.

The Kashoo dashboard gives you a thorough overview of all of your finances in one place and features quick and comfortable navigation. You can set everything up, run reports, post banking transactions, and do many other things with ease.

Adding Your Income and Expenses: You can add all of your banks and credit cards to your account for the full financial reconciliation. The automatic entry of your credits and debits into your accounts will be aided by this. However, it won’t take more than a minute to manually add your income and expenses.

Creating and Sending Invoices: Kashoo makes it simple to create and send invoices to your clients. Simply input the required details, download it as a PDF file, and email it to your clients. By including your logo on invoices, you can personalize and brand them.

The last plus point we highly recommend is that Kashoo can make and print your checks is a feature that not all Accounting Software For Small Enterprise in use today offers. You can write checks and print them with Kashoo, or you can enter transfers between accounts. With 5 significant features below, Kashoo deserves the Best Accounting Software For Small Enterprise.

3. How Kashoo can help small enterprises?

The user interface of Kashoo’s new 2.0 edition, which was published in 2022, had several significant improvements. Additionally, every feature was improved, including contacts, accounts, bill payments, and many others. The cloud-based Kashoo small company accounting solution now available is incredibly simple to set up and lets you connect your bank accounts and add tax payments. Let’s find out what salient features of Kashoo- the Best Accounting Software For Small Enterprise have helped small businesses:

- Dashboard:

Kashoo offers in-depth dashboards that include data on your earnings, spending, cash deposits and withdrawals, net income, and net cash balances. In addition, all the data is constantly updated.

All of your postings to the general ledger as well as postings from the additional bank accounts you connected are included in the dashboard totals. Additionally, it displays numerous graphs and charts along with the journal entries that you uploaded to the program.

- Invoices:

Kashoo software is a very quick and efficient invoicing system; it takes only a minute to create an invoice or add the necessary client information to an item. Once you’ve created a new invoice, you can select one of the alternatives listed under the Save tab: duplicate your invoice, save your invoice, make a new one, save and return to the invoice feature.

The payment link checkbox will show up if you need to accept credit card payments from your customers. The credit card option is also available during setup, and you have the choice of printing or mailing your invoices and bills. The invoices Kashoo offers are standard ones, and the only modification choices are to add your logo or a special message to the invoice.

- Bills to Pay:

You may quickly manage your vendor bills with this function. It displays an overview of totals including total bills for the year, total days required to pay a vendor bill, the total amount outstanding, and total invoices past due. Under the New tab, it’s simple to add new bills and easily provide the required data or invoices. Unfortunately, this service does not support direct payments, however, you can manually add payments.

- Journal Entries:

The Add Adjustment screen in Kashoo makes it simple to enter entries in your journal. You can include a description of your diary entry there. The warning message will appear if your journal entry’s debit and credit totals do not match.

You can add bank accounts to the program in order to significantly simplify the process of entering numerous diary entries. However, you must use the Add Adjustment option if you need to add the depreciation entry.

- Accounts Payable:

Kashoo software features a well-designed accounts payable feature that enables you to add bills, set up recurring bills, or view all of your overdue bills.

- Bank Reconciliation:

Kashoo enables complete bank account reconciliation.

- Accounts Receivable

Kashoo has sufficient receivables management capabilities to accommodate small firms with a worldwide focus.

- Billing and Invoicing:

Kashoo Accounting Software For Small Enterprise’s billing features are fairly basic; you can manually add bills and records, but direct payments through Kashoo are not supported. You can quickly generate, customize, and mail your invoices from within your account when it comes to invoicing. Additionally, you may set up recurring invoices to keep track of your customers’ accounts or add other features to your invoices, including sales taxes.

- Budgeting and forecasting:

The Kashoo dashboard offers a respectable level of forecasting functionality that enables you to make predictions for the upcoming quarter. Additionally, you can see information about your monthly and yearly totals, expenses, and AP and AR balances. Additionally, using features for the prior month and prior year, you can quickly compare the received data.

- Cash Management

Accessing your profit, loss, and cash flow statements is quite simple with Kashoo. Your income and expenses are reviewed on the Kashoo dashboard, which enables small businesses to better manage their cash flow.

- Client & Supplier Contacts:

You may quickly save information about your clients and suppliers with Kashoo. Default income accounts and sales tax rates are a few examples of the data you can add.

- Users & Account Management:

Kashoo Accounting Software For Small Enterprise’s most important feature is its unlimited, cost-free user capacity. You can also add more than one business, but doing so will cost you more money. Additionally, you may give individuals access to four different levels, which is quite helpful.