In the ever-evolving landscape of business management, the role of technology cannot be overstated. One crucial aspect of business operations is accounting, as accurate financial management is essential for sustainability and growth. In this context, open source accounting software has emerged as a game-changer for businesses of all sizes. This article delves into the significance of open source accounting software for businesses, its advantages, and some prominent options available in the market.

Contents

Understanding Open Source Accounting Software

Open source accounting software is a type of financial management software that is developed and distributed with an open source license. This means that the source code of the software is made available to the public, allowing anyone to view, modify, and distribute it. This collaborative approach not only encourages transparency but also fosters innovation as developers from around the world can contribute to the software’s enhancement.

Advantages of Open Source Accounting Software

1. Cost Efficiency

One of the primary advantages of open source accounting software is its cost-effectiveness. Traditional accounting software often comes with significant upfront costs and ongoing licensing fees. In contrast, open source solutions can be downloaded and used for free. This eliminates the burden of licensing expenses, making it particularly attractive for small businesses and startups with limited budgets.

2. Customizability

Open source accounting software provides a high degree of flexibility and customizability. Businesses can tailor the software to suit their specific accounting needs and industry requirements. This level of customization ensures that the software aligns perfectly with the company’s processes and workflows, leading to improved efficiency and accuracy.

3. Transparency and Security

Transparency is a cornerstone of open source software. With the source code accessible to the public, any vulnerabilities or security issues can be identified and addressed quickly by the developer community. This transparency instills confidence in businesses that their financial data is being handled securely.

4. Community Support

The open source nature of the software fosters a vibrant community of developers, users, and contributors. This community support translates to timely updates, bug fixes, and a wealth of resources such as forums and documentation. Businesses using open source accounting software can tap into this collective knowledge pool to resolve issues and gain insights.

5. Scalability

As businesses grow, their accounting needs evolve. Open source accounting software is designed with scalability in mind. It can accommodate increased data volume, users, and transactions without compromising performance. This scalability ensures that the software remains a viable solution as the business expands.

6. Integration Capabilities

Modern business operations often rely on a suite of software applications. Open source accounting software can seamlessly integrate with other tools, such as customer relationship management (CRM) systems, enterprise resource planning (ERP) software, and e-commerce platforms. This integration streamlines data flow across different departments, enhancing overall operational efficiency.

Prominent Open Source Accounting Software

Several open source accounting software options are available in the market, each with its own set of features and capabilities. Here are some notable choices:

1. GNUCash

GNUCash is a widely recognized open source accounting software designed for personal and small business use. It offers features like double-entry accounting, invoicing, expense tracking, and financial reporting. With its user-friendly interface and comprehensive documentation, GNUCash is a great starting point for those new to accounting software.

2. Odoo

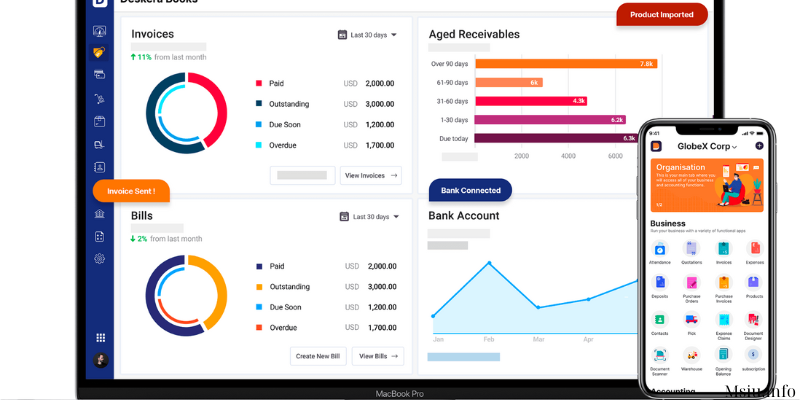

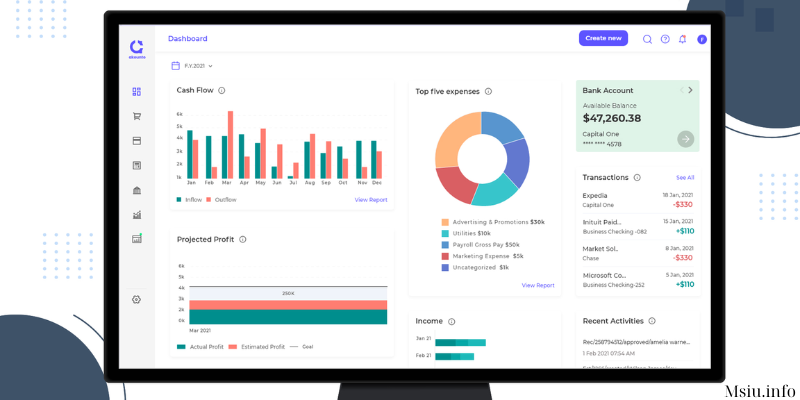

Odoo is a robust open source ERP software that encompasses various business modules, including accounting. It provides features for managing invoices, bank reconciliation, expenses, and more. Odoo’s modular approach allows businesses to start with basic accounting functionalities and gradually expand into other areas like CRM, inventory management, and human resources.

3. ERPNext

ERPNext is another open source ERP solution that includes accounting capabilities. It offers features such as general ledger, accounts receivable, accounts payable, and tax management. ERPNext is known for its simplicity and user-friendly interface, making it suitable for small to medium-sized businesses.

4. PostBooks

PostBooks is an open source accounting and ERP system developed by xTuple. It includes features like financial reporting, inventory management, and customer relationship management. PostBooks is particularly favored by businesses that require integrated accounting and inventory control.

5. FrontAccounting

FrontAccounting is tailored for small businesses and nonprofit organizations. It covers core accounting functions like general ledger, invoicing, bank reconciliation, and reporting. FrontAccounting’s lightweight design and straightforward interface make it easy for users to navigate and manage their finances.

Implementing Open Source Accounting Software Effectively

While open source accounting software offers numerous advantages, its successful implementation requires careful consideration and planning. Here are some key steps to ensure a smooth transition:

1. Assess Your Business Needs

Begin by assessing your business’s accounting requirements. Consider factors such as the volume of transactions, reporting needs, and integration with other software systems. This evaluation will help you choose an open source accounting solution that aligns with your specific needs.

2. Data Migration

If you’re transitioning from a different accounting software, ensure a seamless data migration process. Clean and organize your existing financial data before migrating it to the new system. This step is critical to maintaining data accuracy and integrity.

3. Customization and Configuration

Take advantage of the customization options offered by open source accounting software. Tailor the software to match your business processes and workflows. Configure settings related to chart of accounts, tax codes, and payment methods according to your requirements.

4. Training and Support

Provide training to your accounting team on how to use the new software effectively. While open source solutions are often designed to be user-friendly, proper training can accelerate the learning curve and ensure that your team utilizes the software’s full potential. Additionally, leverage the available community resources and support forums for troubleshooting and guidance.

5. Regular Updates

Stay up to date with software updates and patches released by the developer community. Regularly updating the software ensures that you benefit from bug fixes, security enhancements, and new features. Develop a routine maintenance schedule to keep your accounting operations running smoothly.

Conclusion

Open source accounting software has transformed the way businesses manage their finances. With its cost-effectiveness, flexibility, and collaborative community, it presents an attractive alternative to traditional proprietary solutions. Businesses can choose from a variety of open source options, each offering unique features to cater to different needs. However, successful implementation requires thoughtful planning, customization, and ongoing maintenance. By harnessing the power of open source accounting software, businesses can streamline their financial management processes, enhance transparency, and position themselves for sustainable growth in a dynamic business landscape.