Managing rental properties can be a lucrative business, but it comes with its fair share of challenges. One of the most critical aspects of successful property management is effective accounting and financial management. To maintain a healthy bottom line, minimize risks, and ensure compliance, property owners and managers need efficient accounting tools. Rental property accounting software is the solution that can revolutionize the way you manage your real estate investments. In this article, we will explore the benefits, features, and considerations when using rental property accounting software.

Contents

The Importance of Rental Property Accounting Software

Efficient accounting is the backbone of any successful rental property management strategy. It helps property owners and managers keep track of income, expenses, and profits, ensuring the financial health of their investments. There are several key reasons why rental property accounting is essential:

1.1. Legal Compliance: Real estate is subject to various tax laws and regulations. Proper accounting ensures compliance with these legal obligations, reducing the risk of penalties and audits.

1.2. Financial Transparency: Accounting provides transparency into the financial health of your rental properties. This transparency is crucial for decision-making, investor communication, and overall business growth.

1.3. Expense Tracking: Tracking expenses helps property owners understand where their money is going, identify cost-saving opportunities, and maximize profitability.

1.4. Reporting and Analysis: Accounting software provides in-depth financial reports and analysis, enabling property owners to make informed decisions and plan for the future.

The Role of Rental Property Accounting Software

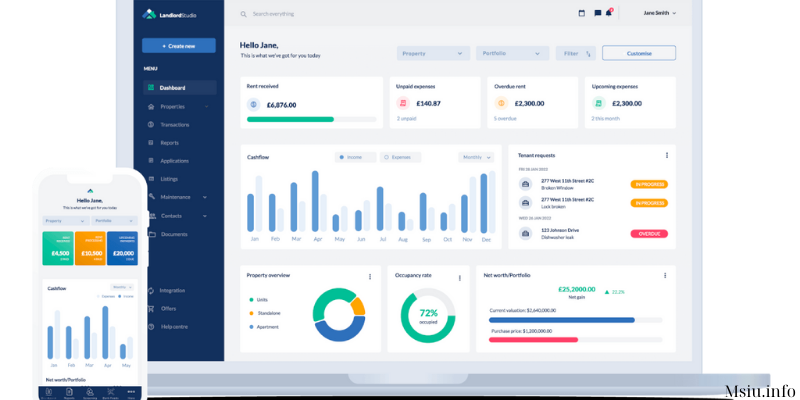

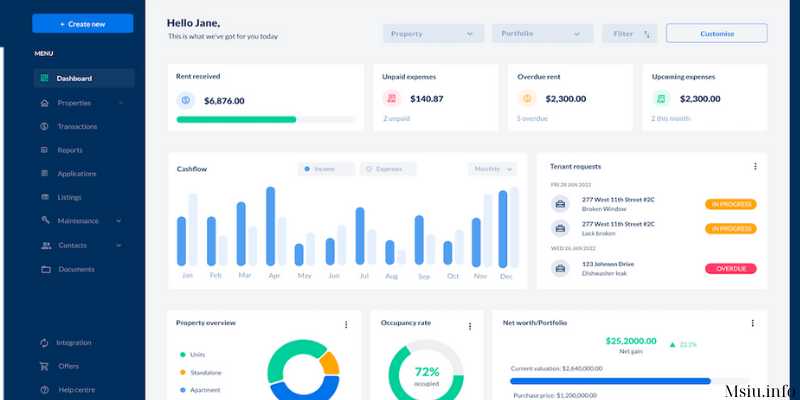

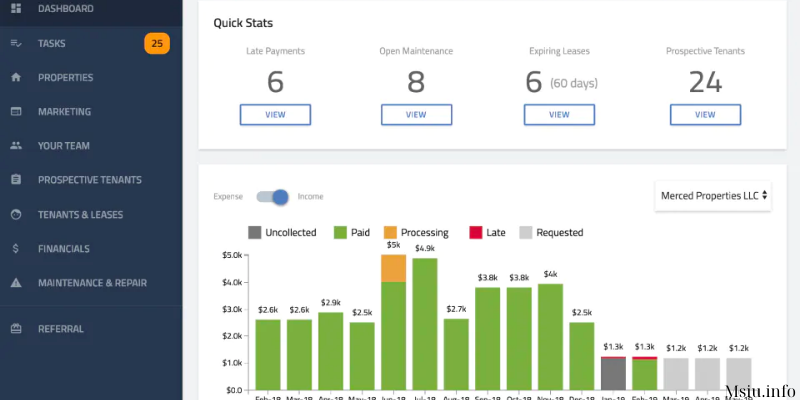

Rental property accounting software is a specialized tool designed to streamline and simplify the financial management of real estate investments. This software is equipped with features tailored to the unique needs of property managers and landlords. Let’s explore the key roles and functions of rental property accounting software:

2.1. Rent Collection and Tracking

One of the primary functions of rental property accounting software is to automate rent collection and tracking. It allows landlords and property managers to set up recurring rent payments, accept online payments, and generate rent receipts. This reduces the administrative burden of rent collection and minimizes the risk of late or missing payments.

2.2. Expense Tracking and Management

Rental property accounting software enables users to record and categorize expenses related to their properties. This includes property maintenance, repairs, insurance, utilities, and property management fees. The software provides a clear overview of expenses, making it easier to manage budgets and identify cost-saving opportunities.

2.3. Financial Reporting

Robust accounting software generates various financial reports, such as income statements, balance sheets, and cash flow statements. These reports provide property owners with insights into their property’s financial performance. They are also essential for tax reporting and investor communication.

2.4. Tax Preparation

Property owners and managers need to comply with tax regulations specific to real estate investments. Rental property accounting software simplifies this process by generating accurate tax reports and summaries. This reduces the risk of errors and ensures compliance with tax authorities.

2.5. Lease Management

Many rental property accounting software solutions come with lease management features. They help you create, store, and manage lease agreements, making it easy to access critical lease information when needed. This is especially valuable for property managers with multiple tenants.

2.6. Property Portfolio Management

For those with multiple rental properties, software allows them to manage their entire portfolio from a single platform. This streamlines operations, making it easier to monitor the performance of each property and manage vacancies.

Benefits of Rental Property Accounting Software

Using rental property accounting software provides numerous benefits that can significantly improve your property management business:

3.1. Time Efficiency

Automating financial tasks, such as rent collection and expense tracking, saves valuable time. Property managers can redirect their efforts towards more strategic activities like property maintenance and tenant relationships.

3.2. Improved Accuracy

Human error in manual accounting processes can lead to costly mistakes. Accounting software eliminates these errors by automating calculations and ensuring data accuracy.

3.3. Enhanced Financial Visibility

Software offers real-time insights into your property’s financial health. This visibility helps you make informed decisions and quickly adapt to changing circumstances.

3.4. Simplified Tax Management

The software simplifies tax reporting by generating accurate tax summaries and reports. This can save property owners significant stress and time during tax season.

3.5. Scalability

Rental property accounting software can scale with your business. Whether you manage one property or a vast portfolio, the software can adapt to your needs and growth.

3.6. Investor Relations

For those who have investors or partners, software enables transparent financial reporting. It’s easier to share financial data and demonstrate the profitability of your real estate investments.

Features to Look for in Rental Property Accounting Software

When choosing the right accounting software for your rental properties, consider the following essential features:

4.1. User-Friendly Interface

Look for software with an intuitive and user-friendly interface. It should be easy to navigate and understand, even if you’re not a financial expert.

4.2. Rent Collection Automation

The software should offer rent collection automation, allowing tenants to pay online and setting up recurring payments.

4.3. Expense Tracking and Categorization

Ensure that the software enables you to track and categorize expenses easily. This feature is vital for effective budget management.

4.4. Financial Reporting

Robust reporting capabilities are essential. Look for software that generates comprehensive income statements, balance sheets, and cash flow statements.

4.5. Tax Management

The software should assist with tax preparation by generating accurate tax summaries and reports, helping you remain compliant with tax authorities.

4.6. Lease Management

If you manage multiple properties, lease management features can be a significant time-saver. Look for software that allows you to store and manage lease agreements.

4.7. Cloud-Based Access

Cloud-based software offers the advantage of remote access from any device with an internet connection. This is especially valuable for property managers on the go.

4.8. Integration Capabilities

Consider whether the software can integrate with other tools or services you use, such as property management software or accounting platforms.

4.9. Customer Support

Excellent customer support is crucial in case you encounter issues or have questions about the software. Check if the software provider offers responsive support.

Conclusion

Rental property accounting software is a powerful tool that can transform the way you manage your real estate investments. It offers time efficiency, financial accuracy, and enhanced financial visibility. Whether you have one property or a vast portfolio, the right software can simplify your financial management and improve the profitability of your rental properties.

Before making a decision, assess your specific needs, budget, and any existing tools you use. By selecting the right software, you can streamline your property management operations and ensure financial success in the competitive world of real estate investment.